Categories

New Blog

Tags

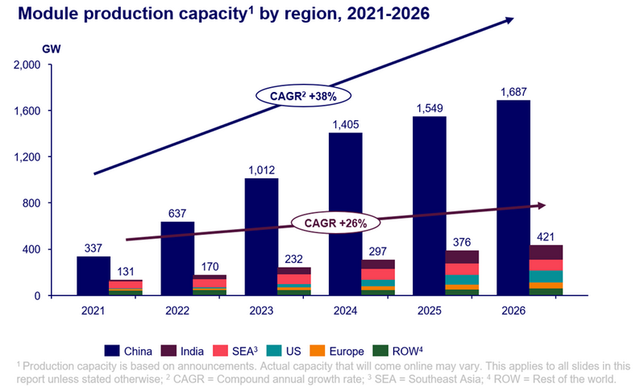

By 2026, China will have more than 80% of the world’s photovoltaic manufacturing capacity

Nov 13, 2023Research shows that despite the introduction of local manufacturing policies in overseas markets, China will still dominate the global photovoltaic supply chain and widen the gap in technology and cost.

According to a recent research report titled "How Will China's Market Expansion Affect the Global Photovoltaic Module Supply Chain?" released by research firm Wood Mackenzie, after investing more than US$130 billion in the photovoltaic industry in 2023, China will By 2026, it will have more than 80% of the world's polysilicon, silicon wafer, photovoltaic cells and photovoltaic module manufacturing capabilities.

Huaiyan Sun, author of the study and senior consultant at Wood Mackenzie, said: “While the expansion of China’s photovoltaic manufacturing industry has been affected by falling polysilicon prices, technological upgrading and the development of local manufacturing in overseas markets, China will still dominate the global photovoltaic supply chain and Continue to widen the technology and cost gap with competitors."

According to Wood Mackenzie's annual market demand growth forecast, China's silicon wafer, photovoltaic cell and photovoltaic module production capacity is expected to exceed 1TW by 2024, which means that China's production capacity is sufficient to meet global annual demand from now to 2032.

China's capacity expansion will continue its dominant position in the global photovoltaic industry with its advanced technology, low cost and complete supply chain.

The introduction of strong policies in overseas markets has begun to strengthen local photovoltaic manufacturing, but compared with photovoltaic products supplied by China , it is still not cost-competitive. According to the research report, the price of photovoltaic modules made in China is 50% lower than that of photovoltaic modules made in Europe, and 65% lower than that of photovoltaic modules made in the United States.

Since 2022, the United States and India have announced planned PV module production capacity of more than 200GW, driven by the US Inflation Reduction Act (IRA) and India's Production-Linked Incentives Act (PLI).

Huaiyan Sun said: "Although there are considerable expansion plans for photovoltaic modules in overseas markets, overseas markets will still be unable to eliminate their dependence on China's silicon wafers and photovoltaic cells in the next three years."

N-type photovoltaic cells are the next generation technology after p-type photovoltaic cells. China plans to manufacture n-type photovoltaic cells of more than 1TW and will continue to maintain its global technology leadership. This means that China's n-type photovoltaic cell production is 17 times that of the rest of the world.

Looking beyond China, India is expected to overtake Southeast Asia as the second largest PV module production region by 2025, driven primarily by incentives under India's Production Linked Incentives Act.

Industry insiders are concerned about an oversupply in the market due to old production lines that produce less efficient photovoltaic products, such as p-type photovoltaic cells and M6 photovoltaic cells. Demand for p-type photovoltaic cells will begin to decline from 2023, and Huaiyan Sun expects that by 2026, demand for p-type photovoltaic cells will account for only 17% of supply.

NUUKO POWER has more than 10 years of experience in the photovoltaic industry and has provided high-quality and efficient 270W to 700W photovoltaic module products and customized solutions to more than 70 countries around the world.